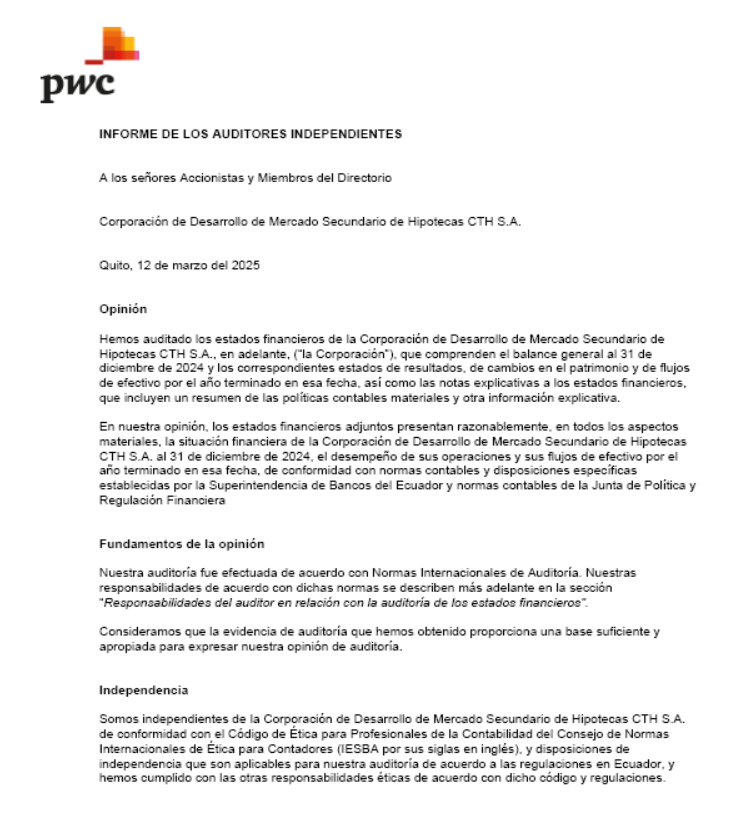

Balance general

|

(USD MILES) |

dic-22 |

dic-23 |

dic-24 |

|

dic-25 |

|||||

|

|

|

|

|

|

|

|

||||

|

|

|

|||||||||

|

Activo |

USD |

% |

USD |

% |

USD |

% |

|

USD |

% |

|

|

Fondos Disponibles |

157.89 |

0.7% |

265.37 |

1.0% |

124.70 |

1.0% |

|

225.19 |

1.5% |

|

|

Inversiones |

1,901.61 |

8.1% |

1,122.19 |

4.4% |

7,583.45 |

58.7% |

|

7,552.55 |

48.8% |

|

|

Cartera de cr ditos |

12,409.04 |

52.8% |

4,571.82 |

18.1% |

3,244.75 |

25.1% |

|

6,624.50 |

42.8% |

|

|

Cuentas por cobrar |

3,184.88 |

13.6% |

11,701.19 |

46.3% |

1,291.73 |

10.0% |

|

598.28 |

3.9% |

|

|

Bienes realizables |

359.82 |

1.5% |

319.84 |

1.3% |

199.90 |

1.5% |

|

54.21 |

0.4% |

|

|

Propiedades y equipos |

446.24 |

1.9% |

396.06 |

1.6% |

341.44 |

2.6% |

|

315.58 |

2.0% |

|

|

Otros Activos |

5,025.21 |

21.4% |

6,922.34 |

27.4% |

128.94 |

1.0% |

|

116.58 |

0.8% |

|

|

Total Activo |

23,484.69 |

100.0% |

25,298.81 |

100.0% |

12,914.91 |

100.0% |

|

|

15,486.87 |

100.0% |

|

|

||||||||||

|

Pasivo |

|

|||||||||

|

Cuentas por Pagar |

1,826.56 |

12.8% |

1,470.07 |

8.8% |

1,269.75 |

31.3% |

|

1,837.01 |

29.4% |

|

|

Obligaciones Financieras |

6,200.00 |

43.3% |

11,700.00 |

70.0% |

1,930.00 |

47.6% |

|

4,380.00 |

70.2% |

|

|

Valores en Circulaci n |

6,102.60 |

42.6% |

3,367.02 |

20.1% |

668.78 |

16.5% |

|

- |

0.0% |

|

|

Otros Pasivos |

187.33 |

1.3% |

187.33 |

1.1% |

187.33 |

4.6% |

|

25.44 |

0.4% |

|

|

Total Pasivo |

14,316.49 |

100.0% |

16,724.41 |

100.0% |

4,055.86 |

100.0% |

|

|

6,242.44 |

100.0% |

|

|

||||||||||

|

Capital Social |

3,943.41 |

43.0% |

3,943.41 |

46.0% |

3,943.41 |

44.5% |

|

3,943.41 |

42.7% |

|

|

Prima o Colocaciones de acciones |

46.68 |

0.5% |

46.68 |

0.5% |

46.68 |

0.5% |

|

46.68 |

0.5% |

|

|

Reservas |

3,995.64 |

43.6% |

3,998.99 |

46.6% |

3,998.99 |

45.1% |

|

3,998.99 |

43.3% |

|

|

Super vit por valuaciones |

- 55.17 |

-0.6% |

- 39.14 |

-0.5% |

248.50 |

2.8% |

|

137.25 |

1.5% |

|

|

Resultados |

29.94 |

0.3% |

35.48 |

0.4% |

41.03 |

0.5% |

|

41.03 |

0.4% |

|

|

Resultado del Ejercicio |

1,207.69 |

13.2% |

588.97 |

6.9% |

580.44 |

6.6% |

|

1,077.07 |

11.7% |

|

|

Total Patrimonio |

9,168.20 |

100.0% |

8,574.40 |

100.0% |

8,859.05 |

100.0% |

|

|

9,244.43 |

100.0% |

|

|

||||||||||

|

Total Pasivo + Patrimonio |

23,484.69 |

|

25,298.81 |

|

12,914.91 |

|

|

|

15,486.87 |

|

Estado de resultados

|

(USD MILES) |

dic-21 |

dic-22 |

dic-24 |

dic-25 |

||||

|

|

|

|

|

|

|

|||

|

USD |

% |

USD |

% |

USD |

% |

USD |

% |

|

|

Intereses ganados |

2,753.41 |

54.1% |

4,588.03 |

66.8% |

1,497.01 |

27.1% |

3,064.67 |

50.3% |

|

Comisiones |

- |

- |

- |

- |

||||

|

Utilidades financieras |

- |

0.0% |

6.00 |

0.1% |

2.00 |

0.0% |

0.69 |

0.0% |

|

Total Ingresos Financieros |

2,753.41 |

54.1% |

4,594.03 |

66.9% |

1,499.01 |

27.2% |

3,065.35 |

50.3% |

|

Intereses causados |

711.36 |

14.0% |

1,278.59 |

18.6% |

481.48 |

8.7% |

277.97 |

4.6% |

|

Comisiones causadas |

80.04 |

1.6% |

39.55 |

0.6% |

15.37 |

0.3% |

13.08 |

0.2% |

|

P rdidas Financieras |

0.07 |

0.0% |

0.04 |

0.0% |

520.94 |

9.4% |

1.21 |

0.0% |

|

Total Egreso Financiero |

791.47 |

15.6% |

1,318.18 |

19.2% |

1,017.79 |

18.5% |

292.26 |

4.8% |

|

Margen Financiero |

1,961.94 |

38.6% |

3,275.85 |

47.7% |

481.22 |

8.7% |

2,773.09 |

45.5% |

|

Ingresos ordinarios |

- |

0.0% |

- |

0.0% |

- |

0.0% |

- |

0.0% |

|

Ingreso por servicios |

1,888.27 |

37.1% |

1,742.99 |

25.4% |

2,051.05 |

37.2% |

2,016.66 |

33.1% |

|

Egresos de operaci n |

2,210.53 |

43.5% |

2,267.58 |

33.0% |

2,133.68 |

38.7% |

2,189.10 |

35.9% |

|

Margen Operacional |

1,639.69 |

32.2% |

2,751.26 |

40.1% |

398.59 |

7.2% |

2,600.66 |

42.7% |

|

Provisiones, depreciaciones |

91.31 |

1.8% |

2,273.10 |

33.1% |

1,299.42 |

23.6% |

1,620.62 |

26.6% |

|

Ingresos extraordinarios |

444.48 |

8.7% |

532.49 |

7.8% |

1,966.25 |

35.6% |

1,011.34 |

16.6% |

|

Egresos extraordinarios |

37.83 |

0.7% |

39.00 |

0.6% |

103.52 |

1.9% |

227.61 |

3.7% |

|

Utilidad antes de impuestos y participaciones |

1,955.03 |

38.4% |

971.65 |

14.1% |

961.90 |

17.4% |

1,763.76 |

28.9% |

|

Participaci n de los empleados |

293.25 |

5.8% |

145.75 |

2.1% |

144.28 |

2.6% |

264.56 |

4.3% |

|

Impuesto a la renta |

454.08 |

8.9% |

236.93 |

3.4% |

237.17 |

4.3% |

422.13 |

6.9% |

|

Utilidad Neta |

1,207.69 |

23.7% |

588.97 |

8.6% |

580.44 |

10.5% |

1,077.07 |

17.7% |

Indicadores Financieros

|

|

NDICES FINANCIEROS |

dic-22 |

|

dic-23 |

dic-24 |

dic-25 |

|

|

CAPITAL: |

|

|

|

|

|||

|

SOLVENCIA |

53.30% |

36.99% |

104.64% |

103.60% |

|||

|

|

|

|

|||||

|

CALIDAD DE ACTIVOS: |

|

|

|||||

|

MOROSIDAD CARTERA VIVIENDA |

6.52% |

19.70% |

31.30% |

19.53% |

|||

|

MOROSIDAD CARTERA VIVIENDA * |

6.52% |

9.89% |

31.30% |

19.53% |

|||

|

|

|

|

|||||

|

COBERTURA DE LA CARTERA DE VIVIENDA |

225.81% |

172.69% |

134.64% |

160.00% |

|||

|

COBERTURA DE LA CARTERA DE VIVIENDA* |

231.81% |

219.50% |

134.64% |

160.00% |

|||

|

|

|

|

|||||

|

MANEJO ADMINISTRATIVO: |

|

|

|

||||

|

ACTIVOS PRODUCTIVOS |

128.36% |

46.23% |

445.17% |

354.57% |

|||

|

PASIVO CON COSTO |

|||||||

|

|

|

|

|||||

|

ACTIVOS PRODUCTIVOS * |

169.32% |

91.96% |

445.17% |

354.57% |

|||

|

PASIVO CON COSTO |

|||||||

|

|

|

|

|||||

|

|

|

|

|||||

|

GRADO DE ABSORCI N: |

|

|

|

|

|||

|

GASTOS OPERATIVOS |

59.78% |

83.20% |

166.76% |

70.25% |

|||

|

MARGEN FINANCIERO |

|||||||

|

GASTOS DE PERSONAL |

5.84% |

5.09% |

7.76% |

9.12% |

|||

|

ACTIVO TOTAL PROMEDIO |

|||||||

|

GASTOS OPERATIVOS |

10.98% |

9.52% |

14.15% |

16.56% |

|||

|

ACTIVO TOTAL PROMEDIO |

|||||||

|

|

|

|

|||||

|

RENTABILIDAD |

|

|

|

|

|||

|

ROA: |

RESULTADO DEL EJERCICIO |

5.14% |

2.37% |

3.65% |

7.71% |

||

|

ACTIVO PROMEDIO |

|||||||

|

ROE: |

RESULTADO DEL EJERCICIO |

15.17% |

7.38% |

7.01% |

13.19% |

||

|

PATRIMONIO PROMEDIO |

|||||||

|

|

|

|

|||||

|

* Incluye cartera hipotecaria transferida al fideicomiso de titularizaci n que est en etapa de acumulaci n |

|

|

|||||